SPED is a common term with every business in Brazil, no matter the size or location. SPED stands for “Sistema Público de Escrituração Digital” in English, it means “Public system of Digital bookkeeping”.

In 2007, the tax authorities at federal and state-level administrations took the initiative to create an ultra-modern digital system. The main aim of this system is to replace paper copies of invoices and tax records.

Since then, the SPED system has evolved considerably to accommodate the new tax legislation and to cover all types of business and industry sectors.

SPED has become the new fiscal compliance system in Brazil, and every company must submit their filings electronically at regular intervals. The compliance process starts by sending every electronic invoice to the SPED system. The process of communication between taxpayers and tax authorities is mandatory. It includes getting authorisation for issuing the invoice and confirming receipt by the recipient of the invoice.

In Brazil, there are five different types of electronic invoices which are the basis for the compliance process:

NFe: Nota Fiscal Electronica for goods movements

NFSe: Nota Fiscal for Services

CT-e: Transportation invoices

NFC-e: Coupam nota fiscal for transactions between B2C

MDF-e: Electronic tax manifest

The tax authorities hold these business transaction events between all the taxpayers, enabling them to monitor tax avoidance and other criminal activities.

Along with the invoices, all taxpayers must submit tax filings, and they consists of twelve modules and seven different ancillary reporting requirements.

The seven ancillary obligations are:

⦁ eSocial: a program to streamline HR and payroll in order to submit all the employee information on a monthly basis

⦁ ECD: the digital accounting bookkeeping documents which are delivered once a year before May 31st

⦁ ECF: this is the digital tax return,created in 2014, which is delivered once a year before July 31st

⦁ EFD: Contrubuicoes: this is a monthly obligation of reporting digital tax documents to the federal tax authorities (PIS and Cofins)

⦁ EFD-ICMS/IPI: this is a monthly obligation to report digital tax documents to the state tax authorities (CISM and IPI)

⦁ EFD-ReInf: digital bookkeeping and monthly reporting of withholdings and information on Social Security contributions

⦁ e-Financeira: this is a compliance obligation for banks

Precision medicine is focused on defining the molecular profile of an individual’s physiological status. Many internal and external factors can influence physiological changes and define the individual’s risk of a disease.

External factors such as diet, lifestyle, sleep, stress, socioeconomic status, geography, early life experiences and physical activity combined with internal factors relating to genetic background, gut microbiome, metabolism, inflammatory status are all critical factors in determining the individual’s health and disease risk profile.

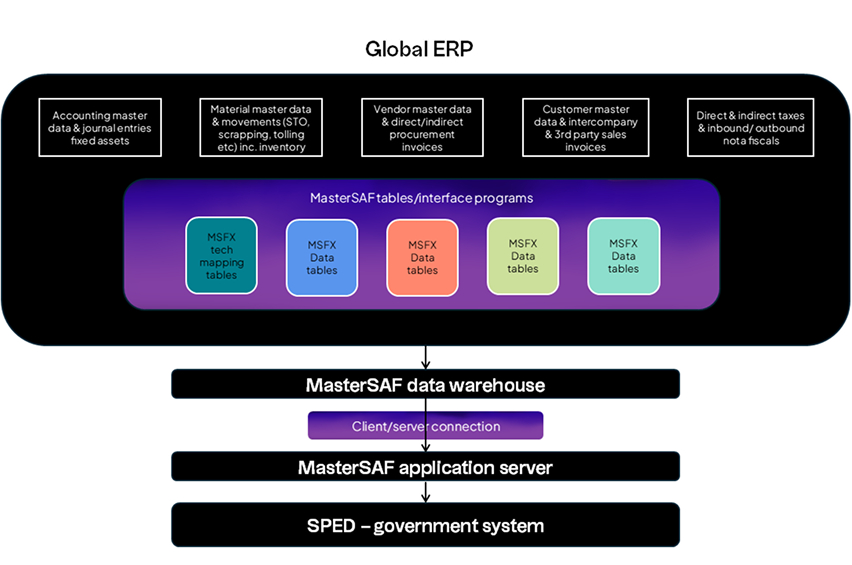

MasterSAF Technical Architecture includes MasterSAF Data Warehouse and MasterSAF Application Systems (Citrix). MasterSAF DW solution consists of a traditional client-server system in two layers. The client layer is written in Power Builder and the server layer is implemented in an Oracle database.

The client layer has a basic purpose to receive and display information for the system user, almost all the functional logic being implemented in the server layer.

Thomson Reuters provides a solution package (Transport and Files) that can be imported into the client’s ERP system and configured to suit the business processes and compliance reporting requirements.

The package is imported into the client’s system using a specific namespace for MasterSAF. This namespace has all the data mappings and process configuration to support the SPED reporting.

MasterSAF delivers the mapping of these fields in the following three categories:

⦁ Standard fields: As part of the base build of the package, the MasterSAF fields are mapped to default to fields in the ERP system.

⦁ Parameterisation: Namespace parameterisation tables/fields are configurable fields to the MasterSAF fields based on the business processes. Parameterisations (config objects) which apply to the client are maintained in the system so that the data can be fed to relevant MasterSAF fields.

⦁ Non-treated fields: These are the fields where the MasterSAF package doesn’t provide a direct mapping with source fields; hence the mapping of the data can be achieved through customised processes. The customised processes are defined based on the client ERP system capabilities and underlying data standard issues.

Thomson Reuters releases MasterSAF versions every year and patches every two weeks to ensure product updates are aligned with the most up to date legal changes.

In addition, these patches involve several changes implemented in the product (functional, operational or technical changes) by client requests or Thomson Reuters’ initiative. These patches are available on Thomson Reuters portal (Contact Centre) for all clients.

Clients need to keep their system in line with the most up to date patch level of the Thomson Reuters patch. If the patch level is less than two levels of the latest MasterSAF patch, then Thomson Reuters product support team will not provide any support in the case of issues.

Our professionals have led a significant number of projects in the tax technology space for our clients and would be an ideal partner throughout your journey by providing an experienced team who: