On average, OECD (Organisation for Economic Co-operation and Development) countries raised 32.3% of their tax revenues from consumption taxes such as Value Added Tax (VAT); this is mainly due to the fact that all OECD countries levy higher rates of VAT.

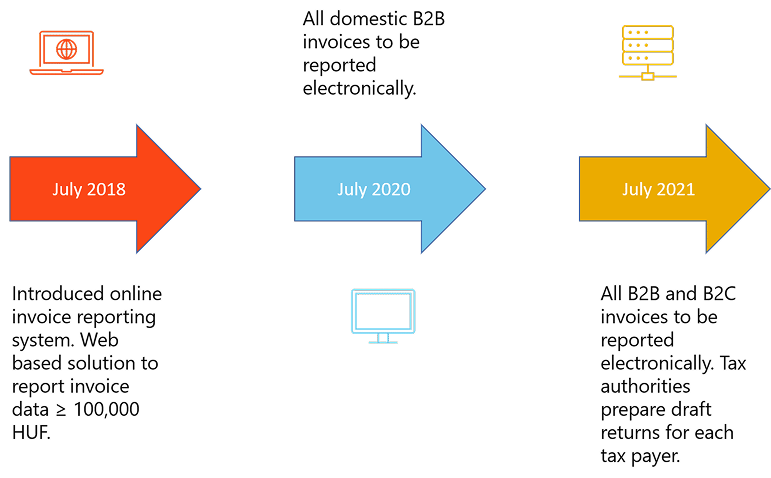

Hungary has the highest VAT rate amongst the OECD countries, making their VAT revenues as a percentage of GDP the highest. To sustain or increase tax revenues and reduce VAT fraud, the Hungarian tax authorities introduced the Real Time Invoice Report (RTIR).

The main purpose of the RTIR is two-fold, firstly to increase the visibility of business-to-business transactions where the VAT is more than HUF 100,000 (roughly £250). This is to enable the tax authorities to increase tax revenues but also to curb the shadow or informal economy.

Secondly, it assists The Hugarian National Tax & Customs department Nemzeti Ado-es Vamhivatal (NAV), with more transparency on economic processes and enables the tax authorities to prepare and propose the draft VAT returns for each tax payer.

Tax payers should report all invoices for domestic supply of goods and services and are required to report the same to the National Tax & Customs Administration (NTCA) as per schedule no 10 of the Act CXXVII of 2007 on Value Added Tax.

Any technical solution will be entirely based on the underlying ERP system that is being used for processing the transactions or for generating the B2B and B2C invoices.

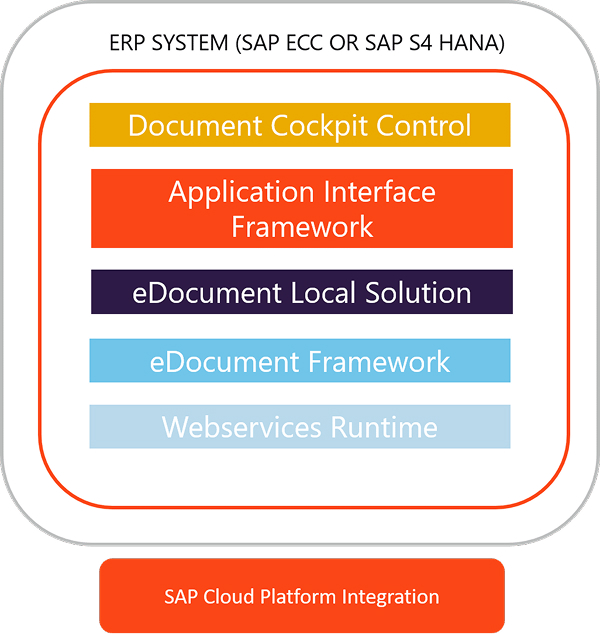

If a company is on S4 HANA or SAP ECC as their ERP system, with additional licencing cost, the SAP Document Compliance System can be used to transmit the invoice data electronically and also receive the authorisation back from the tax systems.

For companies that are not using SAP as their ERP system then there are multiple third-party software solutions that can be used as a bolt-on tool; this bolt-on acts like a messaging system between the ERP system and NAV to transmit the invoice data out and obtain the necessary authorisation back in.

The SAP DRC system is a HANA based cloud architecture platform that is used to exchange data between business-to-business, business-to-consumer and business-to-government.

The system architecture involves:

The sub-components that are involved in the SAP Document Compliance System are:

Document Cockpit Control: this shows the list of invoices with the relevant status; it can be used as a workbench to trigger different steps in exchanging the information between ERP systems and other third party systems (customers, consumers or government agencies).

Architecture Interface Framework: this component reads the transactional data from a source document and generates an eDocument. The eDocument is then stored in AIF in XML format.

eDocument Local Solution: this is where country specific data maps with the local country specific requirements.

eDocument Framework: this is the component which integrates the responses from the tax authorities systems with the eDocument (XML file) that is stored in AIF; it also maintains or tracks the status of the document and updates the eDocument with the appropriate protocols.

Webservice Runtime Framework: this actually transmits the data from the document compliance module to the SAP Cloud Platform Integration to enable communication with third party systems.

Our professionals have led a significant number of projects in the tax technology space for our clients and are an ideal partner for any business. We lead our clients through their journey by providing an experienced team who: