One of the world’s most complex tax systems – Brazil has over 80 different taxes at federal, sate and municipal level.

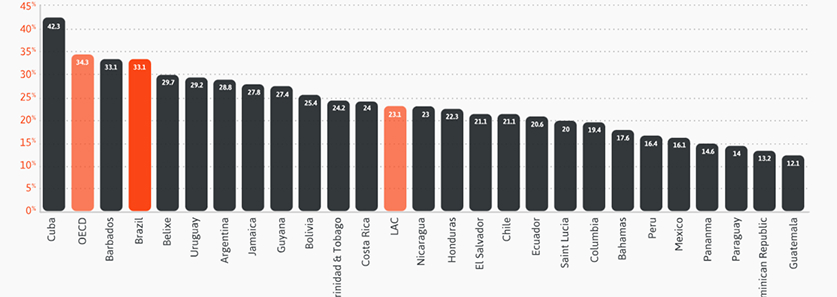

Despite seemingly moderate tax rates, tax revenue accounts for 33% of Brazilian GDP – one of the highest of all LATAM and Caribbean countries (OECD, 2018).

The complexity of the Brazilian tax system, split into 3 levels of jurisdiction, presents challenges for those doing business in Brazil:

State Taxes – 26 Brazilian states and 1 federal district all impose value-added taxes:

Municipal taxes – taxes levied on individuals or corporations who are rendering or procuring a service:

Brazilian taxes compound at federal, state, and municipal levels. The complex method and principles applied to calculating corporate taxes vary based on; the jurisdiction, type of tax, size of the company, industry, or even the physical location of the business.

Even the most sophisticated ERP systems like SAP or Oracle aren’t always able to offer a solution that meets these complex requirements. With the support of tax technology experts, consulting companies develop customised solutions to fulfil the legal fiscal requirements and remove barriers to doing business in Brazil.

Special regimes offer tax incentives to certain industries and promote industrialisation in specific regions. Offered at a state tax level, special incentives vary from state to state, including differences in the ICMS-ST legislation. For example, Parana and Acre have ‘Special Region’ status, and businesses there enjoy certain benefits on ICMS taxes. Similarly, pharmaceutical firms enjoy incentives at a federal level, such as IPI and social contribution taxes on revenue (PIS and COFINS).

In order to meet the intricate requirements, Enterprise resource planning systems commonly require customised solutions for tax determination at the transactional level.

Standardised ERP systems cannot apply the many variations of criteria that determine the tax rate on a particular transaction. Localised versions of software, built specifically to manage the Brazilian tax system, have been developed to manage the complexity. Dynamic determination of tax rates for each transaction is applied, based on criteria derived from both master and transactional data.

Amendments to existing legislation or the introduction of new legislation by tax authorities at all levels are common occurrences in the Brazilian tax system.

Companies need to invest in adaptive EPR systems where tax parameters can be amended to meet the changing legal requirements. In most cases, these changes are not immediate, but there will be little time to react and implement a system update to accommodate the change.

Businesses often rely on experienced tax consulting partners and Brazilian tax technology experts to implement such updates and ensure regulatory compliance.

To ensure compliance with Brazilian GAAP reporting requirements, certain accounting principles need to be followed – such as at what granular level the gross revenue, tax revenue, and net revenue are recorded.

Like all aspects of the Brazilian tax system, the requirements are fluid based on a variety of factors like the size of the company or the industry they operate in. The regulations for claiming input tax credits differ based on the type of purchase or in which process the inputs are being consumed. For example, the impact of the Cumulative vs. Non-Cumulative regimes for social contribution taxes on revenue (PIS / COFINS).

To comply with these complicated accounting requirements, intricate changes to ERP systems may be required.

Our team are experts in implementing tax technology projects in the most complex regimes of the LATAM region and will provide experience in: