SPED is a popular term with every business in Brazil, no matter the size or location. SPED stands for “Sistema Público de Escrituração Digital” in English, it means “Public system of Digital bookkeeping”.

In 2007, the tax authorities at federal and state-level administrations took the initiative to create an ultra-modern digital system. The main aim of this system is to replace paper copies of invoices and tax records.

Since then, the SPED system has evolved considerably to accommodate the new tax legislation and to cover all types of business and industry sectors.

SPED has become the new fiscal compliance system in Brazil, and every company must submit their filings electronically at regular intervals. The compliance process starts by sending every electronic invoice to the SPED system. The process of communication between taxpayers and tax authorities is mandatory. It includes getting authorisation for issuing the invoice and confirming receipt by the recipient of the invoice.

In Brazil, there are five different types of electronic invoices which are the basis for the compliance process:

NFe: Nota Fiscal Electronica for goods movements

NFSe: Nota Fiscal for Services

CT-e: Transportation invoices

NFC-e: Coupam nota fiscal for transactions between B2C

MDF-e: Electronic tax manifest

The tax authorities hold these business transaction events between all the taxpayers, enabling them to monitor tax avoidance and other criminal activities.

Along with the invoices, all taxpayers must submit tax filings, and they consists of twelve modules and seven different ancillary reporting requirements.

The seven ancillary obligations are:

⦁ eSocial: a program to streamline HR and payroll in order to submit all the employee information on a monthly basis

⦁ ECD: the digital accounting bookkeeping documents which are delivered once a year before May 31st

⦁ ECF: this is the digital tax return,created in 2014, which is delivered once a year before July 31st

⦁ EFD: Contrubuicoes: this is a monthly obligation of reporting digital tax documents to the federal tax authorities (PIS and Cofins)

⦁ EFD-ICMS/IPI: this is a monthly obligation to report digital tax documents to the state tax authorities (CISM and IPI)

⦁ EFD-ReInf: digital bookkeeping and monthly reporting of withholdings and information on Social Security contributions

⦁ e-Financeira: this is a compliance obligation for banks

1300

750

Complexity and Technology

The complexity of the compliance process varies based on the type of industry and the number of operational locations and types of operations for each company.

For example, in the Pharmaceutical industry sector, if the company has both a manufacturing facility and commercial operations, then the number of filings and the amount of data to be reported digitally is considerably higher than a company that is just acting as a distributor.

In general, the amount of data required to fulfil either Tax or Accounting SPED is very high. It consists of tax-related information and the necessary logistics and production processes data—for example, Batch information, Bill of materials, etc.

Some of the critical data objects that are key for the SPED reporting are:

⦁ Unique product master data details.

⦁ Supplier data with the size and type of business. For example, Lucro Preumido, Lucro real, etc.

⦁ Customer data with the size, type of business and special regimes (if applicable).

Each tax / accounting SPED filing requires different data standards and file formats. The method of communication between taxpayer and SPED system is different based on type of filings. This could be either electronic filing in XML format or TXT file format.

MasterSAF – the “magic tool”

Due to the complexities of Brazilian tax legislation and frequent changes, the ERP systems or other satellite systems currently being used to issue or receive the nota fiscals are not technically capable enough to support the complexity of the SPED reporting requirements.

It is prevalent for a medium or large enterprise in Brazil to rely on a bolt-on solution integrating with the existing ERP systems to manage the SPED compliance requirements.

There are several bolt-on products available in the Brazilian market, but out of those, the most popular product across different industry sectors is MasterSAF, a Thomson Reuters product from the OneSource Tax family.

MasterSAF provides a comprehensive and integrated fiscal and tax reporting solution, it gathers the tax and accounting information in a single database, enabling the generation of reports in compliance with the Brazilian tax authority at federal, state and municipal levels.

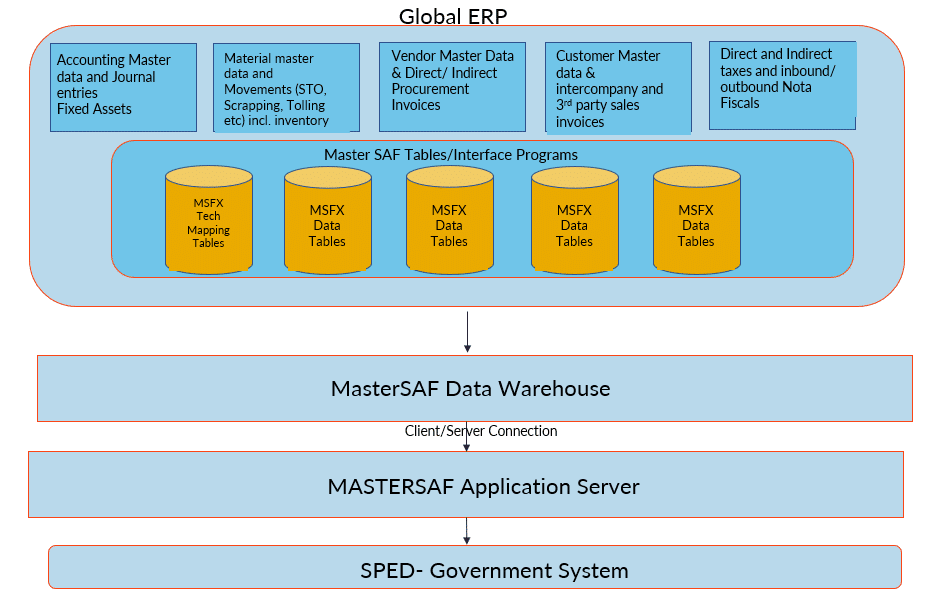

MasterSAF Technical Architecture

MasterSAF Data Warehouse

MasterSAF Technical Architecture includes MasterSAF Data Warehouse and MasterSAF Application Systems (Citrix). MasterSAF DW solution consists of a traditional client-server system in two layers. The client layer is written in Power Builder and the server layer is implemented in an Oracle database.

The client layer has a basic purpose to receive and display information for the system user, almost all the functional logic being implemented in the server layer.

MasterSAF Namespace

Thomson Reuters provides a solution package (Transport and Files) that can be imported into the client’s ERP system and configured to suit the business processes and compliance reporting requirements.

The package is imported into the client’s system using a specific namespace for MasterSAF. This namespace has all the data mappings and process configuration to support the SPED reporting.

MasterSAF delivers the mapping of these fields in the following three categories:

⦁ Standard fields: As part of the base build of the package, the MasterSAF fields are mapped to default to fields in the ERP system.

⦁ Parameterisation: Namespace parameterisation tables/fields are configurable fields to the MasterSAF fields based on the business processes. Parameterisations (config objects) which apply to the client are maintained in the system so that the data can be fed to relevant MasterSAF fields.

⦁ Non-treated fields: These are the fields where the MasterSAF package doesn’t provide a direct mapping with source fields; hence the mapping of the data can be achieved through customised processes. The customised processes are defined based on the client ERP system capabilities and underlying data standard issues.

MasterSAF Versions and Releases

Thomson Reuters releases MasterSAF versions every year and patches every two weeks to ensure product updates are aligned with the most up to date legal changes.

In addition, these patches involve several changes implemented in the product (functional, operational or technical changes) by client requests or Thomson Reuters’ initiative. These patches are available on Thomson Reuters portal (Contact Centre) for all clients.

Clients need to keep their system in line with the most up to date patch level of the Thomson Reuters patch. If the patch level is less than two levels of the latest MasterSAF patch, then Thomson Reuters product support team will not provide any support in the case of issues.

Helixr’s Strength:

Our professionals have led a significant number of projects in the tax technology space for our clients and would be an ideal partner throughout your journey by providing an experienced team who:

- Understands the tax rules applicable for pharmaceutical manufacturing processes and commercial distribution processes

- Consists of experts who know the end-to-end processes on how to manage the contract manufacturing process in line with the ICMS tax legislation for states like Rio de Janeiro and Sao Paulo

- Understands the requirements of the electronic nota fiscal and has experience of numerous projects in implementing the tax rules

- Can define the end to end processes from master data standardisation to transactional processing and to SPED submissions.

Our experts

To speak to one of our experts and find out more about this topic and how Helixr can help your business, please get in touch via our Contact form.